Iran's Annual Budget: Unpacking Priorities & Economic Realities

Table of Contents

- Overview of Iran's Budgetary Landscape

- Economic Challenges and Budget Deficits

- The Role of Oil Revenues and State Assets

- Priorities in Spending: Military and Security Forces

- The Curious Case of IRIB's Budget

- Social Welfare and Public Services

- Taxation and Revenue Generation

- Broader Implications and Future Outlook

Overview of Iran's Budgetary Landscape

The process of drafting and approving the annual budget of Iran is a critical event in the nation's political and economic calendar. Each year, the government presents its financial roadmap to the Majlis (parliament), outlining anticipated revenues and planned expenditures for the upcoming Iranian year, which typically begins on March 21st. For instance, the detailed text of Iran’s new budget bill for the year starting March 21 was released by the Iranian government on Monday, March 31. This process is a testament to the complex bureaucratic machinery at play in managing the country's finances. President Ebrahim Raisi, for example, has been central to this process in recent years. He submitted his first draft budget bill for the Iranian year 1401 (starting March 21, 2022) and later, on January 11, presented his budget proposal to the Majlis for the Iranian year 2023/24. State media gave the value of the draft budget for the next Iranian year (starting March 21, 2023) at about 21,640 trillion rials, which was slightly over $53 billion at the free market rate at the time. This massive sum underscores the scale of the financial operations managed by the Iranian government, even as the country grapples with significant economic headwinds. The annual budget of Iran is not merely a collection of numbers; it is a strategic document that reflects the regime's priorities and its approach to governance in a challenging environment.Economic Challenges and Budget Deficits

Iran's economy has been under immense pressure for years, largely due to international sanctions, internal mismanagement, and a heavy reliance on oil revenues. These challenges are starkly reflected in the nation's persistent budget deficits. The government's inability to balance its books is a recurring theme, leading to inflation and economic instability that directly impact the lives of ordinary citizens. For example, Iran recorded a government budget deficit equal to 5.50 percent of the country's gross domestic product in 2023, a significant figure that highlights the ongoing fiscal strain. This deficit is a direct consequence of spending outpacing revenue generation, a predicament exacerbated by fluctuating oil prices and limited access to international markets. The context in which these budgets are drafted is often fraught with tension. The proposal for the 2023/24 budget, for instance, was drafted amid the most severe protests the Islamic Republic had faced since its establishment in 1979. Despite the widespread public discontent and economic hardship, the budget proposal included "no economic olive branches to the people" and "avoided structural reforms that could help rein in inflation and fuel growth." This indicates a government prioritizing stability and its core institutional structures over immediate economic relief for the populace, even as Iran struggles with soaring inflation and a weakening economy, leading to what many perceive as misaligned government spending priorities.Recent Deficit Trends

While deficits remain a concern, there have been some fluctuations. Iran recorded a government budget deficit of 4909119.30 IRR billion in 2022, which is a substantial figure. However, there was a period of improvement, as the deficit of government budget in Iran decreased to 1258000 IRR billion (equivalent to 29.782 billion USD) in 2020. This data, published yearly by the Central Bank, provides a crucial historical context for understanding the trajectory of Iran's fiscal health. Despite temporary improvements, the overall trend points to an economy struggling to generate sufficient non-oil revenues and manage its expenditures effectively, consistently putting pressure on the annual budget of Iran. The persistent deficits underscore the urgent need for diversification and structural reforms that have, thus far, been largely absent from budgetary proposals.The Role of Oil Revenues and State Assets

Oil revenues have historically formed the backbone of Iran's national budget. Despite efforts to diversify, the economy remains heavily dependent on hydrocarbon exports, making it vulnerable to global oil price fluctuations and international sanctions. The annual budget of Iran not only highlights the massive share of oil revenues but also the significant portion of the national budget allocated to the military and security forces. This allocation is further complicated by provisions that facilitate these institutions’ acquisition of state assets. This practice effectively transfers public wealth and strategic resources into the hands of powerful, often opaque, entities, raising concerns about transparency, accountability, and the equitable distribution of national resources. The reliance on oil, coupled with the strategic allocation of state assets, creates a complex economic landscape. While oil provides a crucial source of foreign currency, its volatility and the impact of sanctions mean that the government often struggles to predict and secure consistent revenue streams. The ability of military and security forces to acquire state assets also blurs the lines between state and private enterprise, potentially hindering economic competition and innovation. This structural dependency and the specific allocation mechanisms within the annual budget of Iran are key factors in understanding the country's economic resilience and its vulnerabilities.Priorities in Spending: Military and Security Forces

One of the most striking aspects of the annual budget of Iran is the substantial and consistently growing allocation to its military and security apparatus. This reflects a strategic priority for the Iranian leadership, focused on national defense, regional influence, and internal security, often at the expense of other vital sectors. As Iran struggles with soaring inflation and a weakening economy, the government’s spending priorities seem misaligned to many, with the armed forces set to receive a substantial portion of the 2024 budget. This continues a trend observed in previous years, where defense spending has seen significant increases despite economic hardship. The emphasis on military spending is not new. There are multiple sources estimating the military expenditure of Iran, however differences exist between the numbers. For instance, a dispute among U.S. intelligence experts highlights this: while the Arms Control and Disarmament Agency (ACDA) estimated Iranian 1993 expenditure to be $4.9 billion, U.S. intelligence experts believed Iran had spent up to $8 billion that year. These discrepancies underscore the challenges in accurately assessing defense spending in a country with a complex and often opaque financial system. However, the overall trend of significant military investment remains clear.IRGC's Growing Share

A particular focus within military spending is the Islamic Revolutionary Guard Corps (IRGC), a powerful and influential branch of Iran's armed forces. "The budget allocated for the country’s Revolutionary Guard, or IRGC, grew by 14% compared to 2020 and now accounts for 34% of Iran’s total military spending," Iran International noted. This significant increase highlights the IRGC's central role not only in defense but also in economic and political spheres. The 2022 reports regarding military spending were based on data from the Stockholm International Peace Research Institute (SIPRI), a reputable source for global military expenditure data. Beyond its domestic military spending, Iran is also recognized for its financial backing of various regional groups. "Iran’s annual financial backing to Hizballah — which has been estimated to be hundreds of millions of dollars annually— accounts for the overwhelming majority of the group’s annual budget." This statement, attributed to Congressman Bill Huizenga, underscores the broader geopolitical implications of Iran's budgetary decisions. For years, Iran has been recognized as the world’s leading state sponsor of terrorism, a designation that significantly impacts its international relations and economic interactions. These external financial commitments, while not explicitly detailed in publicly released domestic budgets, are a critical component of Iran's overall strategic spending.The Curious Case of IRIB's Budget

The Islamic Republic of Iran Broadcasting (IRIB) holds a unique and often controversial position within the annual budget of Iran. As the state-controlled media conglomerate, IRIB is a powerful tool for disseminating government narratives and shaping public opinion. Its budget allocation has seen substantial increases in recent years, drawing considerable scrutiny given the country's economic struggles and the public's perception of the institution. The budget for the Islamic Republic of Iran Broadcasting (IRIB) has increased significantly, reaching 35 trillion tomans in 2025, compared to 24 trillion tomans in 2024, representing a 43% increase. This massive allocation raises questions about the government's priorities. To put this into perspective, IRIB’s budget also matches the entire budget of the Ministry of Agriculture, despite Iran’s deepening food security crisis. This means the IRIB’s budget surpasses the combined allocations of ten ministries and equals the total budget of the Ministry of Agricultural Jihad. Such a disproportionate allocation, especially when compared to critical sectors like agriculture, highlights a clear preference for ideological control and propaganda over addressing fundamental societal needs. The decision to funnel such vast sums into state media, while essential services struggle, is a stark illustration of the government's strategic focus.Viewership vs. Allocation

What makes the IRIB's budget even more perplexing is the stark contrast between its massive funding and its plummeting viewership. Despite this massive allocation, IRIB’s viewership has plummeted, with an ISPA survey showing only 11.5% of Iranians watch its TV series and 12.5% rely on it for news. This data suggests a significant disconnect between the resources poured into state media and its actual reach and influence among the Iranian populace. The public's declining trust and reliance on IRIB for information indicate a growing preference for alternative, often foreign-based, news sources and entertainment. This situation raises critical questions about the efficiency and effectiveness of government spending. Why allocate such an enormous portion of the annual budget of Iran to an entity that appears to be losing its audience? The answer likely lies in the strategic importance the government places on controlling the narrative, regardless of its perceived success or public acceptance. For the Iranian leadership, IRIB serves as a vital instrument for maintaining ideological cohesion and projecting state power, even if its direct impact on public opinion is waning.Social Welfare and Public Services

Amidst the substantial allocations to defense and state media, the annual budget of Iran also includes provisions for social welfare and public services, albeit often under significant financial constraints. These allocations are crucial for maintaining a semblance of public well-being and addressing the basic needs of the population. However, the economic realities of high inflation and limited resources often mean that these provisions are insufficient to alleviate the hardships faced by many Iranians. One direct impact on citizens comes from the pricing of essential utilities. The budget also includes a 35% increase in the prices of natural gas, electricity, and water. While such increases are often justified by the need to reduce subsidies and generate revenue, they place an additional burden on households already struggling with rising costs of living. For a population grappling with officially around 35% inflation and skyrocketing costs of basic goods like bread, these utility price hikes further erode purchasing power and exacerbate economic stress.Public Sector Salaries and Utilities

To mitigate some of the economic pressures on its workforce and pensioners, the government often includes salary adjustments in the budget. A 25% rise in the salaries of government workers and pensioners has been included in the bill, for example. While this provides some relief, it often struggles to keep pace with the actual rate of inflation, meaning that real wages may still decline. The government's challenge lies in balancing the need to support its citizens with the imperative to manage a strained budget. The tension between these priorities is a constant feature of the annual budget of Iran, reflecting the difficult choices faced by policymakers in a challenging economic environment. The allocation to provinces, while not detailed in the provided data for recent years, has historically been a component of the budget, with "Annual budgets for each province from 1996 to 2014" being a past data point, indicating a history of decentralized allocation.Taxation and Revenue Generation

Beyond oil exports, taxation represents another crucial pillar of revenue generation for the Iranian government. In an effort to diversify income sources and reduce reliance on volatile oil markets, there has been a push to increase tax revenues. For instance, the government earned 1,920 trillion rials (approximately $7.68 billion) from taxation, as stated in the provided data. This figure, while significant, highlights the ongoing challenge of broadening the tax base and improving collection efficiency in an economy heavily impacted by sanctions and a large informal sector. The ability to generate substantial tax revenue is vital for the long-term fiscal health of the annual budget of Iran. However, the current economic climate, characterized by high inflation and a struggling private sector, makes it difficult to significantly increase tax burdens without stifling economic activity. The government faces a delicate balancing act: needing more revenue to fund its expenditures while trying not to further burden businesses and individuals already under immense financial strain. Effective tax policies are essential for sustainable growth and reducing reliance on less stable income streams.Broader Implications and Future Outlook

The annual budget of Iran is a complex document that reflects the multifaceted challenges facing the nation. It is a testament to a government that, while grappling with severe economic pressures, continues to prioritize national security and ideological control. The persistent budget deficits, the disproportionate allocation to military and state media, and the limited economic relief offered to the populace paint a picture of a nation making difficult, and often controversial, choices. The fact that the 2023/24 budget proposal was drafted amid the most severe protests since 1979, yet included no economic olive branches and avoided structural reforms, underscores a leadership focused on maintaining stability through existing frameworks rather than through fundamental economic overhauls. As Iran struggles with soaring inflation and a weakening economy, the government’s spending priorities seem misaligned to many observers. While inflation is officially around 35% and the cost of basic goods like bread is skyrocketing, Iran’s armed forces are set to receive a substantial portion of the 2024 budget. This continued emphasis on defense and security, coupled with a lack of significant structural reforms, suggests that the economic hardships faced by ordinary Iranians are likely to persist. The future outlook for Iran's economy and its annual budget hinges on several factors, including the trajectory of international relations, the effectiveness of internal economic policies, and the government's willingness to address the fundamental grievances of its population through meaningful reforms rather than through increased control. *** In conclusion, the annual budget of Iran is a window into the nation's strategic priorities, its economic vulnerabilities, and the daily struggles of its people. From the significant allocations to defense and state media to the ongoing challenges of budget deficits and inflation, it paints a picture of a government navigating a complex landscape. Understanding these budgetary decisions is crucial for anyone seeking to comprehend the trajectory of this pivotal nation. What are your thoughts on Iran's budgetary priorities? Do you believe the allocations reflect the most pressing needs of the Iranian people? Share your insights and join the conversation in the comments below, or explore our other articles on global economic trends.- Israel Vs Iran Ultimas Noticias

- Iran International Tv Live

- Potenza Militare Israele Vs Iran

- Us Iran Nuclear Talks

- The Shah Iran

Iran's Budget Deficit Skyrockets Amidst Government in 2023

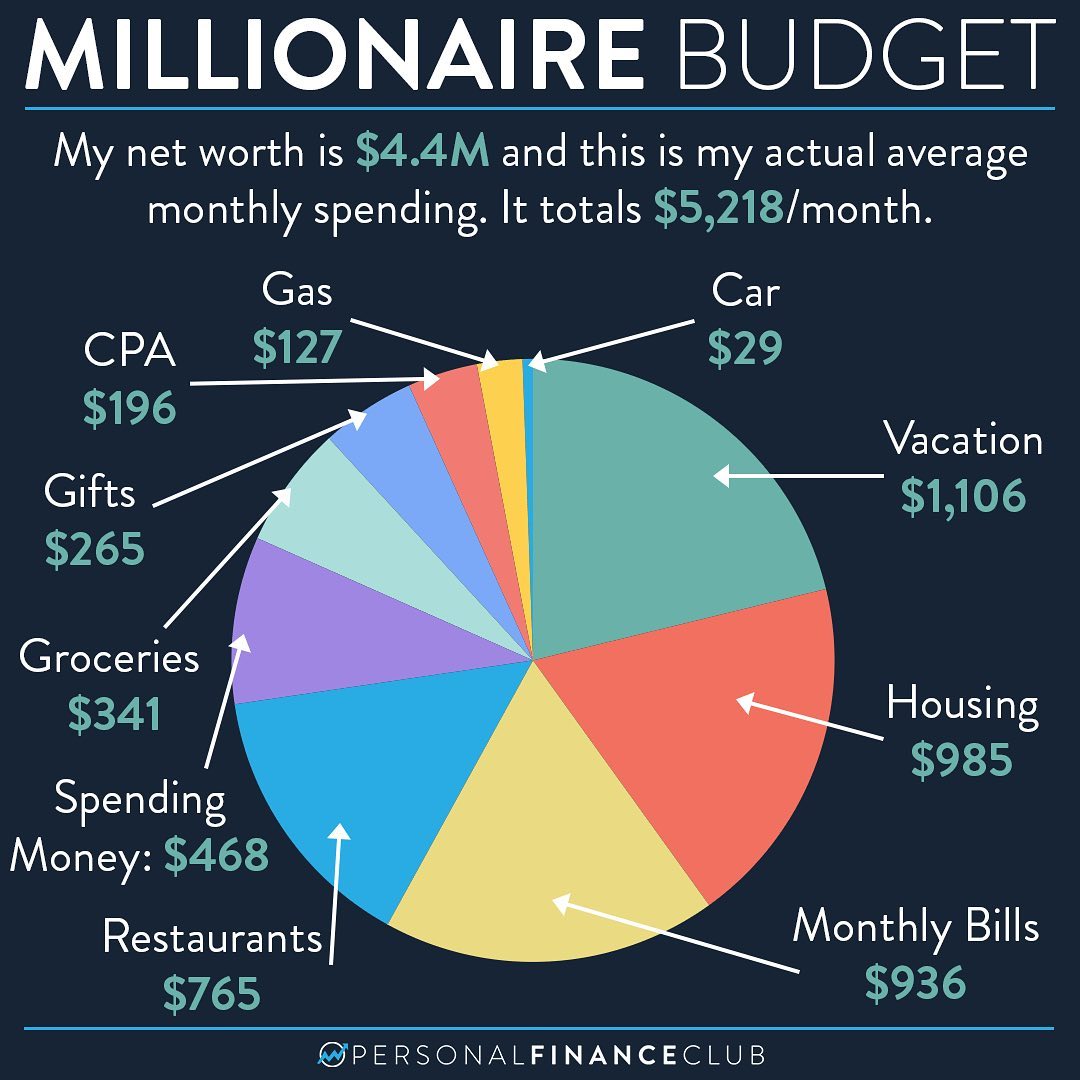

How to budget like a millionaire – Personal Finance Club

Government Budget | Iranian Studies