Iran Sanctions: Unpacking The Economic And Social Toll

A Long History of Sanctions: Roots and Evolution

The imposition of sanctions on Iran is not a recent phenomenon but rather a policy tool that has been consistently employed by the United States for over four decades. This prolonged engagement with economic restrictions has created a unique historical trajectory, shaping both Iranian domestic policy and its international relations. Understanding the evolution of these measures is crucial to grasping the full scope of the **effects of Iran sanctions**.The Genesis: 1979 and Beyond

The initial volley of US sanctions against Iran was launched in November 1979, following a pivotal moment in the relationship between the two nations: the seizure of the American embassy in Tehran and the subsequent hostage crisis. This dramatic event prompted President Jimmy Carter to issue Executive Order 12170. This order was comprehensive for its time, initiating a freeze on approximately $8.1 billion in Iranian assets held in the United States, which included bank deposits, gold, and other properties. Concurrently, a broad trade embargo was imposed, effectively cutting off significant commercial ties between the two countries. From this foundational moment, the rationale behind the sanctions began to solidify: to try to change Iran’s behavior. Over the subsequent decades, as the Islamic Revolution solidified its power and Iran’s regional influence grew, particularly concerning its nuclear ambitions, the scope and intensity of these sanctions expanded significantly. Each new perceived transgression or policy divergence by Tehran often led to further layers of restrictions, targeting different sectors of the Iranian economy and various entities.Escalation and the JCPOA Era

The early 2010s marked a significant escalation in the international community's pressure on Iran, particularly concerning its nuclear program. The sanctions imposed on Iran at the beginning of 2012, largely spearheaded by the United States and the European Union, were particularly stringent. These measures targeted Iran's oil exports, financial institutions, and shipping, aiming to cripple the country's ability to fund its nuclear activities. The objective was clear: to bring Iran to the negotiating table and compel it to dismantle its nuclear enrichment capabilities. This period of intensified pressure eventually led to the landmark agreement known as the Joint Comprehensive Plan of Action (JCPOA), or the Iran nuclear deal, signed in July 2015. The deal represented a significant diplomatic breakthrough, offering a pathway for the lifting of Iran’s economic sanctions in exchange for verifiable curbs on its nuclear program. The agreement went into effect on January 16, 2016, after the International Atomic Energy Agency (IAEA) verified that Iran had completed crucial steps, including shipping 25,000 pounds of enriched uranium out of the country and dismantling key components of its nuclear infrastructure. The lifting of these sanctions, even in a stylized fashion, emphasized three components that were likely to have effects in the near to medium term: a boost in oil exports, access to frozen assets, and reintegration into the global financial system. However, this period of relief was short-lived. In 2018, the United States, under a new administration, unilaterally withdrew from the JCPOA and reimposed a new, even more comprehensive set of sanctions. This move plunged Iran back into severe economic isolation, undoing many of the anticipated benefits of the nuclear deal and reigniting the debate over the efficacy and ethics of such punitive measures. The reimposition of these **Iran sanctions** underscored the volatile nature of international diplomacy and the enduring impact of political shifts on economic realities.The Economic Fallout: A Crumbling Foundation

The economic **effects of Iran sanctions** have been devastating, systematically eroding the country's financial stability and hindering its development. The sustained pressure has targeted the very pillars of the Iranian economy, leading to significant contractions, rampant inflation, and a general decline in living standards.Macroeconomic Contraction and GDP Impact

The statistics paint a stark picture of economic decline. According to the International Monetary Fund (IMF), Iran's gross domestic product (GDP) contracted an estimated 4.8% in 2018, the year the US reimposed sanctions after withdrawing from the JCPOA. The forecast for 2019 was even grimmer, predicting a further shrinkage of 9.5%. This represents a severe economic downturn, indicating a significant reduction in the country's overall economic output and a direct consequence of the renewed pressure. The primary driver of this contraction has been the drastic reduction in Iran's oil exports, which are the lifeblood of its economy. Sanctions have made it exceedingly difficult for Iran to sell its oil on international markets, depriving the government of crucial foreign currency revenues. This, in turn, has impacted the government's ability to fund public services, invest in infrastructure, and maintain economic stability. Beyond oil, other sectors, including banking, automotive, and shipping, have also faced immense pressure, leading to widespread business closures and job losses.The Persistent Cost: Beyond Immediate Effects

The impact of sanctions extends far beyond immediate GDP contraction. The cumulative cost to the Iranian economy has been substantial and long-lasting. For instance, the sanctions imposed at the beginning of 2012 had persistent and significant effects on the Iranian economy. Research indicates that the cost reached its maximum of 19.1% of real gross domestic product four years after the application of these sanctions. This staggering figure highlights the immense economic damage inflicted over time, demonstrating that the effects are not transient but deeply embedded in the economic structure. Furthermore, even after the partial removal of sanctions under the JCPOA, the Iranian economy has not fully recovered. This slow recovery can be attributed to several factors, including the lingering fear among international businesses of potential future sanctions, the difficulty of rebuilding trust and re-establishing complex supply chains, and the inherent structural weaknesses exacerbated by years of isolation. The "snapback" mechanism in the JCPOA, which allowed for the rapid re-imposition of sanctions, also created an environment of uncertainty that deterred long-term investment. The reimposition of full sanctions in 2018 effectively halted any significant recovery, pushing the economy back into a deep recession.Mechanisms of Pressure: Primary and Secondary Sanctions

The effectiveness of **Iran sanctions** lies in their multi-layered design, encompassing both primary and secondary measures. Primary sanctions directly prohibit US persons and entities from engaging in transactions with Iran. These are relatively straightforward and directly impact trade and financial flows between the US and Iran. However, the true coercive power of the US sanctions regime against Iran largely stems from "secondary sanctions." These are extraterritorial measures that target non-US persons and entities for engaging in certain transactions with Iran, even if those transactions do not involve the United States or US persons. For example, if a European bank processes a transaction for an Iranian entity sanctioned by the US, that European bank could face penalties, including being cut off from the US financial system. This creates a powerful deterrent, forcing international companies and financial institutions to choose between doing business with Iran or maintaining access to the much larger and more crucial US market. Kenneth Katzman, a specialist in Middle Eastern affairs, notes that these secondary sanctions on firms that conduct certain transactions with Iran have adversely affected Iran's economy. These measures have successfully isolated Iran from the global financial system, making it incredibly difficult for the country to conduct international trade, even for essential goods. The US has imposed sanctions on key entities like the Atomic Energy Organization of Iran and other companies it says are linked to Iran's nuclear program. Crucially, dozens of banks, including the Central Bank of Iran, have also been targeted, effectively cutting off Iran's access to international banking networks. This financial strangulation makes it nearly impossible for Iran to receive payments for its exports or to pay for its imports, leading to severe shortages and inflation. Janeba's model, which examines the primary and secondary effects of US sanctions on Iran, further elucidates how these intricate mechanisms cascade through the global economy, creating far-reaching consequences that extend beyond direct bilateral trade.Human Cost and Societal Impact

While the economic figures quantify the damage, the true impact of **Iran sanctions** is felt most acutely by the Iranian people. The crumbling economy has translated into tangible hardships, affecting everything from access to medicine to the availability of basic necessities.Pompeo's Perspective and the People's Burden

The stated objective of some sanction proponents has been to incite popular discontent, hoping it would lead to a change in the regime's behavior or even its overthrow. In February 2019, then-Secretary of State Mike Pompeo articulated this strategy in response to a question about the effects of sanctions on Iran, stating, "things are much worse for the Iranian people, and we are convinced that will lead the Iranian people to rise up and change the behavior of the regime." Pompeo made similar statements about US sanctions in Venezuela, indicating a consistent policy approach. However, the reality on the ground for ordinary Iranians is one of increasing struggle. The devaluation of the national currency, the rial, has eroded purchasing power, making imported goods prohibitively expensive. Inflation has soared, driving up the cost of food, housing, and other essentials. This economic pressure has led to widespread unemployment, particularly among the youth, and has fueled public protests and unrest. While the sanctions are ostensibly aimed at the regime, it is the populace that bears the brunt of the economic pain. Access to critical medicines and medical equipment has become severely hampered due to banking restrictions and the reluctance of international suppliers to risk violating sanctions, even for humanitarian goods. This has created a humanitarian crisis, particularly for patients with chronic or rare diseases, highlighting the ethical dilemmas inherent in broad-based economic sanctions.The Diplomacy Dilemma: Sanctions as a Bargaining Chip

Sanctions are often employed as a coercive tool in international relations, intended to force a target state to alter its policies. In the case of Iran, the US has consistently used sanctions to pressure Tehran into reining in its nuclear program and ceasing what it views as destabilizing regional activities. However, the effectiveness of sanctions as a bargaining chip is a subject of ongoing debate. Iran's economy is indeed crumbling after years of US sanctions, and Tehran insists Washington must suspend those restrictions before nuclear talks can begin in earnest. This creates a diplomatic stalemate: the US uses sanctions to gain leverage for negotiations, while Iran demands their removal as a precondition for meaningful dialogue. This cyclical pattern has characterized much of the recent interactions between the two nations, with each side viewing the other's position as an obstacle to progress. The deep distrust built over decades of animosity and punitive measures makes it incredibly difficult to find common ground. While sanctions undeniably inflict economic pain, they have arguably not, to date, altered Iran's fundamental behavior in the way the US intends. This raises questions about their long-term strategic utility versus their immediate humanitarian and economic costs.The Path Forward: Recovery and Future Prospects

The path to economic recovery for Iran, even in the event of a comprehensive lifting of sanctions, remains fraught with challenges. While the removal of restrictions would undoubtedly provide immediate relief, the years of isolation have left deep scars on the Iranian economy. Rebuilding trust with international investors, re-establishing robust trade relationships, and integrating fully into the global financial system will take considerable time and effort. Moreover, the Iranian economy suffers from structural issues that predate the most recent rounds of sanctions, including corruption, inefficiency, and a heavy reliance on oil revenues. Sustainable recovery would require significant domestic reforms, diversification of the economy, and fostering a more transparent and predictable business environment. The experience of the brief period following the JCPOA's implementation in 2016 offered a glimpse of potential, as foreign investment began to trickle in, and oil exports increased. However, the abrupt reimposition of sanctions demonstrated the fragility of such progress. For Iran to achieve lasting economic stability and growth, a sustained period of political stability, both domestically and internationally, coupled with consistent and predictable policy frameworks, will be essential. The future of the **effects of Iran sanctions** hinges on complex geopolitical negotiations and internal reforms.Understanding the Complex Web: A Deeper Dive

To truly grasp the multifaceted **effects of Iran sanctions**, one must appreciate the intricate web of economic, political, and social factors at play. The sanctions are not merely economic tools; they are instruments of foreign policy designed to achieve specific strategic objectives. However, their implementation often leads to unintended consequences and complex feedback loops. For instance, while the primary goal might be to curb Iran's nuclear program, the economic pressure can inadvertently strengthen hardline elements within the regime, who may blame external enemies for the country's woes, thus consolidating their power. Conversely, the suffering of the populace can lead to internal dissent, as seen in various protests over economic conditions. The interplay between these internal and external pressures makes predicting the precise outcomes of sanctions incredibly difficult. Furthermore, the global nature of modern finance means that secondary sanctions can have ripple effects far beyond Iran's borders, impacting companies and economies in third countries that wish to avoid US penalties. The ongoing debate over the effectiveness of sanctions as a foreign policy tool continues, with Iran serving as a prominent case study for both their perceived successes in limiting certain activities and their undeniable failures in achieving broader behavioral change without significant human cost. The complexity of these dynamics underscores why a nuanced understanding, rather than simplistic assumptions, is vital when analyzing the impact of such powerful geopolitical instruments.The **effects of Iran sanctions** are a testament to the profound and often devastating power of economic warfare. From the significant contraction of its GDP, as reported by the IMF, to the persistent and maximum cost of 19.1% of real gross domestic product, the Iranian economy has been systematically crippled. The historical context, from the 1979 asset freeze to the stringent 2012 measures and the subsequent reimposition of sanctions after the JCPOA, reveals a relentless campaign of economic pressure aimed at altering Iran's behavior.

While the mechanisms of primary and secondary sanctions have effectively isolated Iran from global financial systems, impacting everything from oil exports to access to essential goods, the human cost has been immense. Secretary Mike Pompeo's acknowledgment that "things are much worse for the Iranian people" underscores the direct impact on ordinary citizens, who bear the brunt of inflation, unemployment, and limited access to vital resources. The ongoing diplomatic stalemate, where Tehran insists on the suspension of restrictions before nuclear talks can proceed, highlights the inherent challenges of using sanctions as a bargaining chip.

Ultimately, the Iranian case serves as a stark reminder of the complex and often controversial nature of sanctions. While they are a powerful tool in international relations, their efficacy in achieving long-term behavioral change without inflicting severe humanitarian consequences remains a subject of intense debate. Understanding this intricate interplay is crucial for anyone seeking to comprehend the geopolitical landscape of the Middle East. What are your thoughts on the effectiveness of sanctions in achieving diplomatic goals? Share your perspective in the comments below, and consider exploring our other articles on international relations and economic policy.

- Iran Israel Attack

- Israel Vs Iran Who Can Win

- Iran Attacks Israel

- Israel Vs Iran Guerra

- Iran And Israel Conflict

- Why Does Iran Hate Israel

- Iran Vs Israel Who Would Win

- Hezbollah Iran

- Israel Vs Iran Who Can Win

- Israel Military Vs Iran

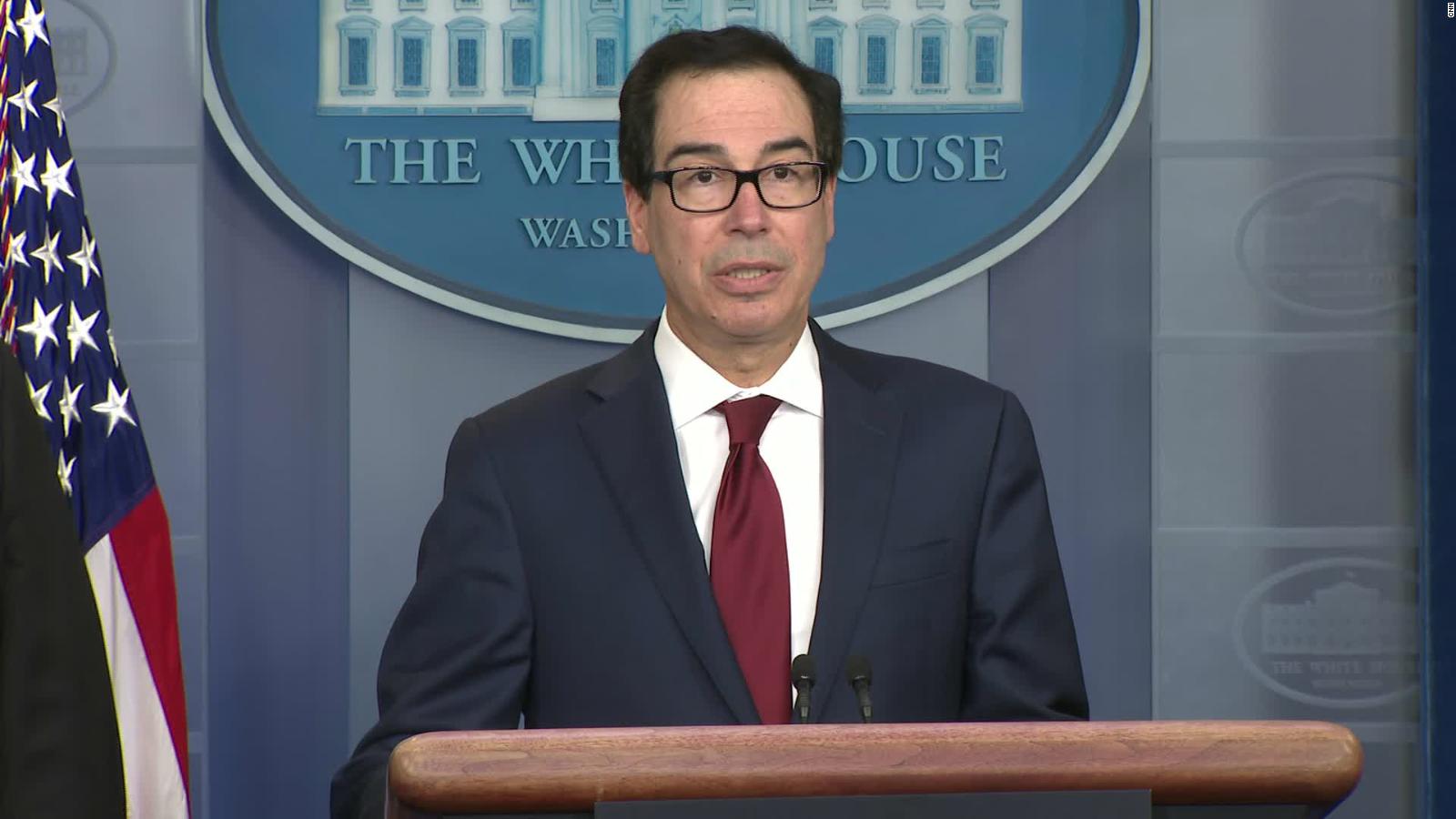

Trump Imposes New Sanctions on Iran, Adding to Tensions - The New York

Sanctions: US imposes new penalties on Iran after attacks - CNNPolitics

Iran Sanctions Explained: U.S. Goals, and the View From Tehran - The