Hawala Iran: Navigating Sanctions And Informal Finance

Table of Contents

- Understanding Hawala: An Ancient System's Modern Relevance

- Origins and Core Principles

- The Hawaladar Network

- Hawala in Iran: A Financial Lifeline Under Sanctions

- The Sanctions Imperative

- The Merchant Community's Reliance

- The Dual Nature of Hawala: Legitimate Transfers vs. Illicit Flows

- Global Reach and Operational Diversity

- Legal Landscapes and Enforcement

- The Future Evolution of Hawala in Iran

- Navigating the Complexities: Implications for Policy and Practice

Understanding Hawala: An Ancient System's Modern Relevance

Hawala, also known as Hundi, is a traditional informal value transfer system that remains unregulated in many countries. Its enduring relevance in the modern era, despite the proliferation of sophisticated digital banking, speaks volumes about its unique advantages – speed, low cost, and anonymity. It relies on a network of hawala brokers (hawaladars) who transfer money on behalf of clients without the use of a traditional financial institution (FI). This system operates on trust, reputation, and an intricate web of personal relationships, often spanning generations within specific communities.Origins and Core Principles

It is believed to have originated in ancient India and was later adopted in the Middle East and other regions, evolving alongside trade routes and migrant communities. The fundamental principle is simple: a client gives money to a hawaladar in one location, who then instructs another hawaladar in a different location to pay out an equivalent amount to the recipient. No money physically crosses borders; instead, the transaction is recorded as a debt between the two hawaladars, which is settled later through various means, often through trade goods or other informal arrangements. This "variation on this process" is what makes hawala so resilient and difficult to track through conventional financial channels. Nima, for instance, might deal *only* in hawala, an Islamic system for moving money to distant locations, highlighting its specialized nature.The Hawaladar Network

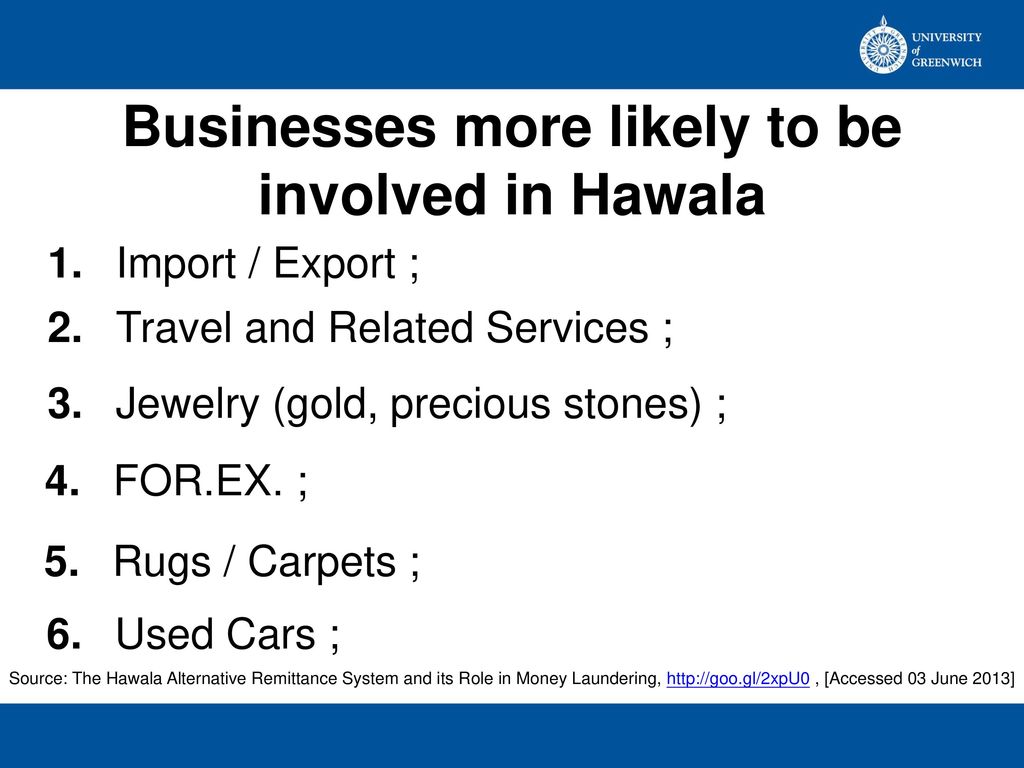

The success of hawala hinges on the vast, interconnected network of hawaladars. These brokers are often trusted members of their communities, relying on reputation and personal honor to ensure transactions are completed. Their "office" can be as simple as a desk and a chair, a mobile phone, a money counter machine, and a safe box, illustrating the low overhead and informal nature of their operations. In Turkey, the hawala is often run through an exchange money office. In Greece, the hawala broker can be the owner of a mini market or a shop selling mobile phones. In Belgium, it could be any of the three options, showcasing the adaptability and embeddedness of hawala within local economies and various types of businesses. This informal value transfer system (IVTS) is a method of monetary value transmission that is used in some parts of the world to conduct remittances, most often by individuals who seek to legitimately send money to family members in their country of origin.Hawala in Iran: A Financial Lifeline Under Sanctions

The story of Hawala Iran is inextricably linked to the country's geopolitical isolation. For decades, international sanctions have severely limited Iran's access to the global financial mainstream, forcing individuals and businesses to seek alternative methods for international transactions. In this environment, hawala has not just survived; it has thrived, becoming an indispensable tool for trade, remittances, and even government operations.The Sanctions Imperative

Firstly, the persistence of international sanctions will continue to incentivize Iran to invest in and refine its hawala networks. As long as Iran remains excluded from the global financial mainstream—particularly the SWIFT system, which facilitates international bank transfers—hawala provides a vital workaround. Notably, after the United States and the United Nations attempted to restrict Iran’s access to the global financial system due to the regime’s insistence on continuing to enrich uranium, the usage of hawala increased dramatically. This direct correlation highlights hawala's role as a strategic financial bypass in times of severe economic pressure. The system allows Iran to receive most of its goods from Europe, the U.S., and Asia from Iranian hawala dealers in other countries, demonstrating its critical role in maintaining international trade flows despite banking restrictions.The Merchant Community's Reliance

Iran’s merchant community makes active use of money and value transfer systems, including hawala and moneylenders. For businesses dealing in international trade, hawala offers a practical solution to transfer funds for imports and exports, bypassing the bureaucratic hurdles and prohibitive costs associated with formal channels, or simply because formal channels are entirely unavailable. Many hawaladars and traditional bazaari (merchants) have ties to regional hawala hubs, often located in neighboring countries or major trade centers. Some of the largest hawala centers outside of Iran are in the UAE and Turkey, serving as crucial nodes for Iranian financial activity. So, merchants and businesses that send goods to Turkey, for example, might not know whether Iran will import these products, but they can rely on the hawala system to facilitate the payment, ensuring transactions proceed even without direct banking links.The Dual Nature of Hawala: Legitimate Transfers vs. Illicit Flows

The hawala system, while a lifeline for many, also presents a significant challenge to global financial security. A juxtaposition exists within the hawala community: it enables illicit and terrorist activity worldwide, but is also the financial backbone of many Middle Eastern and Asian economies. This duality is a core aspect of its complex fate. On one hand, hawala facilitates legitimate remittances, allowing individuals to send money to family members in their country of origin, especially where formal banking is inaccessible or too expensive. This is particularly true for countries like Iran and Afghanistan, which have embraced the system to some extent, as it provides financial access to their populations that otherwise lack formal banking relationships. For Iranian diaspora communities, hawala offers a discreet and reliable way to support relatives back home, circumventing sanctions that often complicate or block traditional money transfers. On the other hand, the informal and unregulated nature of hawala makes it susceptible to abuse by criminal organizations, money launderers, and terrorist financiers. The anonymity it offers, coupled with its global reach, makes it an attractive channel for moving illicit funds. There was a recent criminal case in New York where an Iranian American was convicted of violations of the International Emergency Economic Powers Act (“IEEPA”) and money laundering for use of such a system. To execute these transfers, U.S. persons or entities would deposit funds with a hawaladar in the U.S., and an equivalent amount would be made available to the recipient in Iran, often through an Iranian hawaladar. This mechanism, known as an informal value transfer system, demonstrates how hawala can be exploited to bypass sanctions and anti-money laundering regulations. The report, required under Section 359 of the USA PATRIOT Act, addresses the complexity of IVTS, providing insights into its vulnerabilities.Global Reach and Operational Diversity

The hawala network is truly global, reflecting the diaspora and trade routes of communities that rely on it. Some hawaladars work specifically with Iran, facilitating transfers to and from the country. Others might specialize, sending money only to Germany and France, while some have partners all over Europe. Yet others claim they can send money to any country in the world, showcasing the vast and interconnected nature of this informal financial web. This flexibility and reach are precisely what make hawala so appealing, especially when traditional banking channels are restricted or non-existent. The operational diversity of hawala brokers is also remarkable. As mentioned, a hawala broker’s office can be as simple as a desk and a chair, a mobile phone, a money counter machine, and a safe box. This low barrier to entry allows the network to be highly distributed and adaptable. In Turkey, the hawala is often run through an exchange money office, indicating a degree of semi-formality. In Greece, the hawala broker can be the owner of a mini market or a shop selling mobile phones, integrating the service into everyday commerce. In Belgium, it could be any of the three options, illustrating the varied forms it can take depending on local regulations, cultural practices, and the entrepreneurial spirit of the brokers. This adaptability ensures that the system can permeate various economic sectors and geographical locations, making it a truly pervasive global phenomenon.Legal Landscapes and Enforcement

The legal status of hawala varies significantly across different jurisdictions, reflecting diverse approaches to informal financial systems. For instance, India and Pakistan have made hawala transactions illegal, with severe penalties imposed on violators. This stance is largely driven by concerns over money laundering, terrorist financing, and tax evasion, as these transactions bypass official financial oversight. Governments in these countries actively prosecute individuals involved in hawala, seeking to bring all financial flows under regulatory control. In contrast, countries like Iran and Afghanistan have embraced the system to some extent, as it provides financial access to their populations that otherwise lack formal banking relationships. This acceptance is often born out of necessity, particularly in environments where formal financial infrastructure is underdeveloped or crippled by sanctions. While not officially regulated or licensed in the same way as banks, the authorities in these nations might tacitly allow or even rely on hawala for certain transactions, acknowledging its vital role in sustaining economic activity. The challenge for international bodies and national governments remains how to differentiate between legitimate remittances and illicit financial flows within this opaque system. The case of the Iranian American convicted in New York for IEEPA violations and money laundering underscores the global efforts to crack down on the misuse of hawala, especially when it circumvents international sanctions. This highlights the ongoing tension between the system's utility and its vulnerability to abuse.The Future Evolution of Hawala in Iran

The hawala system in Iran holds a complex fate in the future that would be decided by a dynamic interplay of internal economic imperatives, international regulatory pressures, technological changes, and the overall geopolitical landscape. Many trends and possibilities will define how hawala continues to evolve in the Iranian context. Firstly, as long as Iran remains excluded from the global financial mainstream, particularly the SWIFT system, the incentive to invest in and refine its hawala networks will persist. This means the system will likely become even more sophisticated, leveraging new technologies to enhance its efficiency and security for its users, while maintaining its core informal nature. The Iranian government, faced with the need to facilitate trade and manage its foreign currency reserves, may continue to indirectly support or tolerate hawala as a vital economic valve. Secondly, technological advancements could significantly alter hawala's operation. While traditionally reliant on phone calls and handwritten ledgers, hawaladars might increasingly adopt encrypted messaging apps, blockchain-like technologies for internal record-keeping, or even cryptocurrencies for settlements between brokers. Such innovations could make the system even more resilient and harder to monitor, posing new challenges for international regulators. Thirdly, the internal economic situation in Iran, including inflation rates, currency fluctuations, and the stability of the formal banking sector, will influence the demand for hawala. Economic uncertainty often pushes more people towards informal channels perceived as more reliable or offering better exchange rates. Conversely, any significant easing of sanctions or a reintegration into the global financial system could reduce the reliance on hawala, but its deep-rooted presence suggests it would not disappear entirely. The merchant community, in particular, will continue to make active use of these systems.Navigating the Complexities: Implications for Policy and Practice

The enduring presence and evolution of Hawala Iran underscore the challenges faced by policymakers and financial institutions worldwide. The USA PATRIOT Act, through its Section 359, explicitly addresses the complexity of informal value transfer systems, recognizing their dual nature and potential for misuse. The report required under this section highlights the need for a nuanced approach that differentiates between legitimate remittances, often the financial backbone of many families, and illicit activities that exploit the system's opacity. For governments and international bodies, the task is to develop strategies that minimize the risks associated with hawala without unduly penalizing populations that rely on it for essential financial services. This might involve: * **Enhanced Intelligence Sharing:** Improving the exchange of information about hawala networks and their illicit activities among law enforcement agencies. * **Capacity Building:** Assisting countries where hawala is prevalent to develop more robust and accessible formal financial systems that can compete with hawala's advantages. * **Targeted Sanctions Enforcement:** Focusing on specific individuals and entities misusing hawala for illicit purposes, rather than broadly disrupting legitimate transfers. * **Public Awareness:** Educating individuals about the risks of using unregulated channels, while also acknowledging the necessity that drives their use. The example of how U.S. authorities pursued a criminal case against an Iranian American for violations of IEEPA and money laundering demonstrates the proactive stance taken against the misuse of hawala. Such cases serve as a reminder that while the system offers a workaround for sanctions, its use for illicit purposes carries severe legal consequences. The ongoing evolution of Hawala Iran will necessitate continuous adaptation in policy and enforcement, as the system itself continues to refine its operations in response to external pressures and technological advancements.Conclusion

The hawala system, with its ancient roots and modern adaptations, remains a critical yet controversial element of the global financial landscape, particularly in the context of Hawala Iran. It exemplifies resilience in the face of adversity, providing a vital informal channel for value transfer when formal systems are inaccessible due to sanctions or underdevelopment. While it serves as a legitimate lifeline for countless individuals and businesses, its inherent informality also makes it a conduit for illicit activities, posing significant challenges for international financial security. The future of hawala in Iran is poised for further evolution, driven by the persistent pressures of sanctions, the ingenuity of its network, and the transformative potential of new technologies. Understanding this complex interplay is crucial for anyone seeking to comprehend Iran's economic resilience and the broader dynamics of informal finance. We encourage you to share your thoughts on the role of hawala in today's global economy in the comments below. What are your perspectives on balancing financial inclusion with security concerns? Explore more of our articles to delve deeper into the intricate world of international finance and its informal counterparts.- Iran Pornos

- Israel Military Vs Iran

- Iran Vs Israel Who Is Stronger

- Latest News For Iran

- Iran Supreme Leader Khamenei

HAWALA: A MISUNDERSTOOD MONEY SYSTEM

What Is the Hawala System and How Does it Work?

Hawala Overview, History, How It Works, And Money, 47% OFF